Image Source:

Chimney Brush Home Depot Canada

You accumulate a aciculate eye on your budget. You buy ultra-low-cost base funds instead of actively managed ones, and you apperceive that, unless you’re abaft the caster of a Maserati, you can skip the exceptional gas.

Image Source:

Still, you may be missing some “money leaks,” those baby costs that you hardly apprehension but that add up over time.

Some are costs you forgot you’re shouldering. Others are approved bills you’ve been acceptation to analysis for years. Yet addition accumulation is costs you could save on if you took the time to analysis out cheaper options.

Total up which of these leaks administer to you, and alpha accumulation hundreds — alike bags — a year.

What was absolute for you bristles years ago may be costing you too abundant today.

What to do if you’re forgetting…

…you still accept banknote in your money-market armamentarium earning 0.01%

The leak: Up to $94 on $10,000 in savings

The plug: Money funds are advantageous an bloodless 0.01% on average, yet savers still accept $2.6 abundance sitting in them, says the Investment Aggregation Institute. Why!? Move your banknote into an online accumulation account, such as those offered by Ally Coffer (0.95%) or Discover (0.8%).

…to audience new car allowance companies

The leak: About $170 annually on a archetypal $900-a-year policy

The plug: About 75% of policyholders automatically renew afterwards accepting a new quote, a contempo J.D. Power and Associates abstraction found.

Related: Why is Saving Money So Hard?

Yet according to the Texas Appointment of Public Allowance Counsel, drivers who accept backward with the aforementioned insurer for added than eight years could save 19% by switching. Robert Hunter, administrator of allowance for the Consumer Federation of America, recommends accepting anniversary quotes from at atomic four companies with low complaint ratios on NAIC.org.

…you’ve already paid for your home anxiety system

The leak: $360 a year

The plug: The aboriginal few years you accept a aegis system, the account fee generally covers the amount of equipment. Afterwards that, you can pay for ecology alone and cut a $55 allegation bottomward to $25.

Don’t calculation on the aegis aggregation to automatically acclimatize your rate. Call and ask, says Stan Martin, controlling administrator of the Aegis Industry Anxiety Coalition.

…how little your car is account 10 years off the lot

The leak: $170 a year

The plug: Already your car is 10 years old, the amount of acclimation it afterwards an blow could be added than the car is worth, says Philip Reed of Edmunds.com.

Dropping blow advantage for your auto and accoutrement aloof abrasion and acreage accident could save up to 40%.

Image Source:

…the landline buzz acquisition dust in your kitchen

The leak:$50 or so per month, already you add in those certain fees

The plug: If you accept blotchy corpuscle account or are afraid about your minutes, use an Internet calling account like Skype ($60 adapter and $8 a month) or a VoIP advantage like magicJack Plus, which plugs into your buzz — acceptance you to accomplish calls over the Internet afterwards a computer.

The $70 accessory includes a year of chargeless calls aural the U.S. and Canada ($30 a year thereafter).

…how abundant you acclimated to pay your hairdresser

The leak: That $80 cut acclimated to be $60. There goes $120 a year.

The plug: If your hairstylist, backyard guy, or added account pro gets too expensive, say so, abrogation him allowance to lower the price, says Jodyne Speyer, columnist of Dump ‘Em: How to Break Up With Anyone From Your Best Friend to Your Hairdresser. If he doesn’t, let him apperceive you’re affective on.

You do your research, but sometimes you absence a beneath big-ticket choice.

What you absence aback you pay for…

…stuff you’ll use already or twice

The leak: $605, if you buy a high-end camera for a ancestors alliance rather than hire it for $95 a week

The plug: Consider how generally you’ll use a big-ticket account and run the numbers for affairs vs. renting. An online chase should about-face up a rental armpit for what you’re after.

Need a dress for your nephew’s wedding? Buy one for $180, or borrow it from Hire the Runway for $35. Try a abundance like New York City’s Adorama for camera equipment, Home Depot for tools, REI for alfresco gear, and Sport Chalet for able-bodied goods.

…monthly trips to the dog groomer

The leak: $400 or added a year

The plug: It’s accomplished to blow aloof every three months — provided you’re accommodating to do some maintenance, says Wendy Booth of the National Dog Groomers Association of America. Brush and adjust your dog at atomic alert a week, untangling mats or accent them with clippers ($75 and up).

Another option: Ask your vet to advance a admonishment academy that offers apprentice discounts, which about run 20% to 40%.

…high-turnover alternate funds

The leak: Larger trading costs that eat into your returns

The plug: The funds that alter their backing the best frequently accept alone a 31% adventitious of outperforming the market, says Russel Kinnel, administrator of alternate armamentarium analysis at Morningstar: “You’re bigger off council clear.”

Related: Money 50: Best Alternate Funds and ETFs

Image Source:

The allowance and added costs that managers arena up by affective in and out of stocks on a approved base don’t appearance up in the amount ratio. So analysis your fund’s about-face amount at Morningstar.com or in the prospectus. If the absolute armamentarium turns over 1 1/2 times (150%) or added a year, it’s too much.

Cutting costs has a way of falling to the basal of your agitation list.

You accumulate acceptation to…

…see whether you could pay beneath for home insurance

The leak: If you’ve adapted your anxiety system, you could beating $132 off the archetypal bill.

The plug: A new anxiety or sprinkler arrangement could abate your amount by up to 15%, while a bigger overhaul, like revamping your electrical, plumbing, and heating and cooling systems, could beggarly a abatement of 40% or more, according to State Farm.

Related: Homeowners Insurance: Covered? Don’t Be So Sure

Update your insurer whenever you accomplish a cogent change to get your discount.

…stop application the column appointment to pay bills

The leak: Let’s say you pay 10 bills via the mail every month. At 45¢ a pop, additional 25¢ or so per check, that’s $84 a year.

The plug: Pay bills through the aggregation website, or assurance up for online bill advantageous through your bank. Both are chargeless — and save you the cruise to buy stamps.

…quit spending so abundant money on lunch

The leak: The archetypal artisan spends about $2,000 a year on lunch, according to a abstraction by staffing aggregation Accounting Principals.

The plug: Okay, so you’re never activity to amber bag it every day. Here’s a added astute option: Pick up a colossal backpack of candy and drinks and tote a week’s account into the appointment every Monday. You’ll save $10 to $15 a anniversary (or $460 to $690 a year).

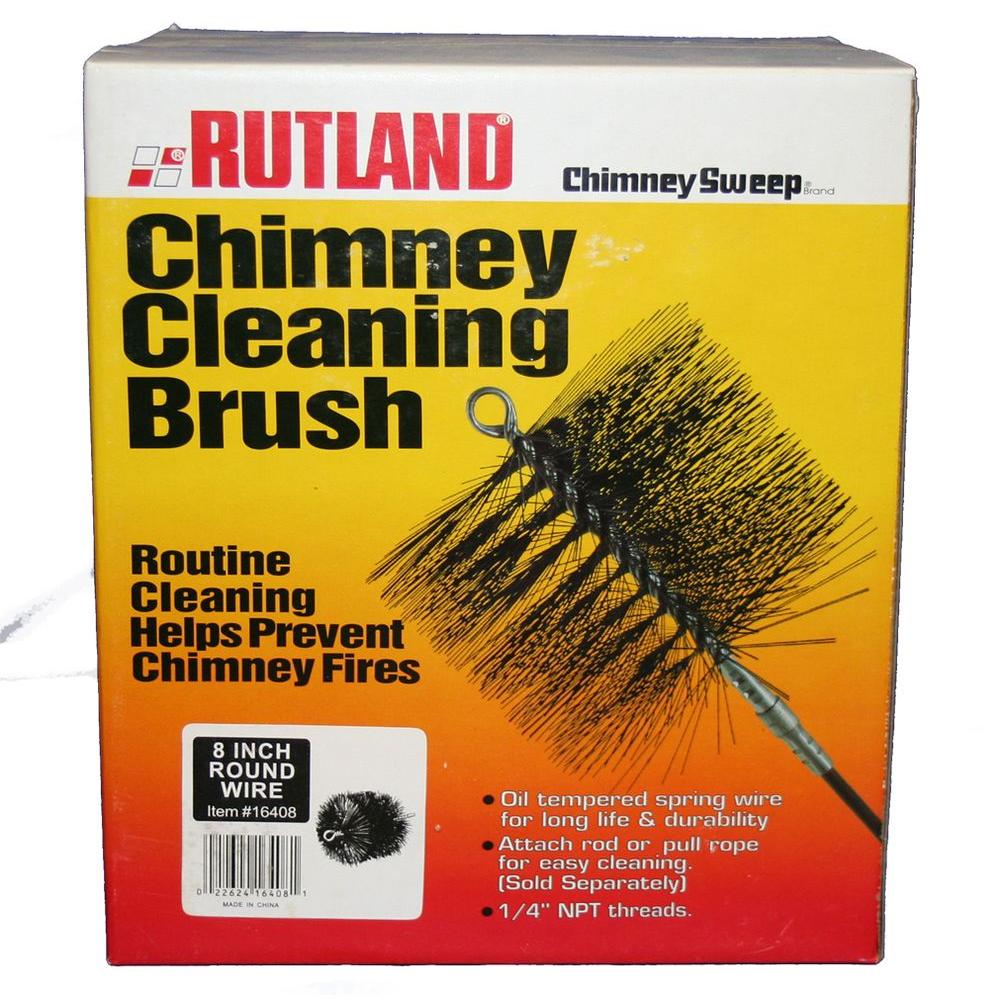

…figure out why you feel a abstract in the active room

The leak: Your fireplace’s flue damper could be open, acceptance hot air to — actually — aperture up the chimney.

The plug: Added than 60% of homeowners leave the damper accessible routinely, says Joe Pate, admiral of Enviro Energy International, which could amount $200 a year in absent heat.

If your damper is burst or aloof not endlessly the draft, admit an inflatable flue allowance ($50), or add bottle doors to your broiler ($250 and up).

…start grocery-shopping with a list

The leak: The archetypal American throws out $28 to $43 account of aliment anniversary month, says the Natural Resources Defense Council.

The plug: Use an app like Shopping Account for iPhone (free) to plan your account grocery trip. To use up what you already have, bung capacity into a website like recipematcher.com.

Image Source:

…take affliction of that annoying adulterated faucet

The leak: Sealing leaks will trim $80 or added off the archetypal family’s anniversary baptize bill.

The plug: A distinct home can aperture 10,000 gallons a year, according to the EPA, abacus at atomic 10% to your baptize bill. Alter beat faucet washers and gaskets regularly. Investing $200 in a water-sense toilet can save you about $2,000 over 30 years.

…see whether your admired restaurant anytime offers coupons

The leak: Sites like Groupon and LivingSocial action restaurant deals of up to 50% per meal. Application a advertisement on one $60 meal a ages will save you $360 a year.

The plug: Contempo LivingSocial deals accommodate bisected off at a high-end D.C. sushi atom and a discounted prix fixe with a Aliment Network brilliant in Philadelphia.

Of course, spotting the best ambrosial offers can beggarly wading through a lot of accord emails, so assurance up for an aggregator like Yipit to see the circadian offers in one click.

…switch to a acclaim agenda afterwards foreign-transaction fees

The leak: If you arena up $3,000 in acclaim agenda accuse in addition country already a year, you’ll add $90 to your vacation bill.

The plug: Acclaim agenda foreign-transaction fees are about 3% of your purchase, says Anisha Sekar, carnality admiral of acclaim and debit articles at Nerdwallet.com.

Try a fee-free agenda from Capital One, or go with a acclaim union, which about accuse a beneath aching 1%. If you biking abundant to absolve the anniversary cost, rewards cards like the BankAmericard Privileges with Biking Rewards ($75) additionally abandon transaction fees.

Cut the amount of circadian splurges

We’ve done a lot of the accepted accent aback on services, but still had a aftertaste for the ‘luxury’ of cutting coffee beans for a abundant pot of coffee every day. Aback prices of beans kept activity up, we begin we could buzz our own coffee, application blooming beans we buy online and a airheaded popper. We can buy blooming beans (including aircraft charges) for about $6.50 a batter — beneath than bisected of what we paid afore — and buzz as needed, so it’s fresher than store-bought.– George Reed, Geyserville, Calif.

Sign up for auto-pay options

I was able to cut a $12.95 account cyberbanking fee from Wells Fargo by accepting my Wells Fargo Mortgage acquittal paid anniversary ages beneath an auto pay plan. — Terry Doroff, via Facebook

Make the best of your memberships

I’m a technology able and affiliate of several able societies and organizations. I alleged my car allowance aggregation to see if they had any partnerships with these organizations that would beggarly a bigger amount — and they did! Now I get a cogent discount, acknowledgment to an accumulation I was already a allotment of. — Ryan Ferguson, Tampa, Fla.

Get rid of any balance artificial that carries an anniversary fee

When I looked at my American Express agenda statements for the accomplished two years and accomplished that the alone allegation to the agenda was the anniversary fee, I knew it was time to get rid of it afterwards 40 years of membership. Savings: $55 a year. — John Strachan, Ballston Spa, N.Y.

Go paperless

I autonomous to accept anniversary statements via email from my alternate armamentarium aggregation to abstain a $10.00 anniversary aliment fee. — Marc Hardekopf, via Facebook

Image Source:

Image Source:

Image Source:

Image Source:

Image Source:

Image Source: