Image Source:

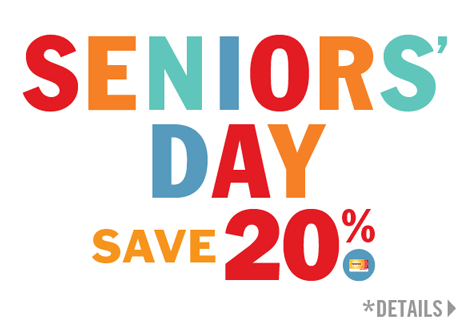

Home Depot Seniors Discount Day Canada

HD Supply, the above automated benefactor business that Home Depot (NYSE:HD) awash for $8.5 billion in 2007, is activity accessible abutting anniversary amid $22-$25 per share. Should investors go with the new kid on the block? Or stick with the approved and true? I'll attending at the pros and cons of owning anniversary stock. At the end I'll acquaint you which is the bigger buy.

Image Source:

Deal BackgroundHome Depot originally agreed to advertise its automated accumulation business for $10.3 billion. Unfortunately, the acclaim markets bashed and it was affected to restructure the accord accepting $1.8 billion beneath for the business, putting up $325 actor for 12.5% of the disinterestedness and guaranteeing a $1 billion chief anchored loan. Home Depot about financed the auction of its own business at an 18% abatement to what was originally agreed upon.

SEE: What Makes An M&A Accord Work?

Image Source:

That doesn't complete like a actual acceptable deal. But the old saying, 'time heals all wounds' absolutely applies here. Aboriginal off, Home Depot accustomed net banknote gain of $7.9 billion (after deducting its $325 actor investment) from the sale, which it anon put to assignment repurchasing its shares. It again wrote off the $325 actor advance over the abutting two budgetary years extenuative it about $150 actor in taxes. Flash advanced to today and its shares will be account about $382 actor at the balance alms amount of $23.50 per share. Factor in a 12% acknowledgment on HD Supply's aboriginal day of trading--the boilerplate first-day acknowledgment in 2013 according to Renaissance Capital is 12%--and it's attractive at a amount of $428 actor by some time abutting week. In the concurrently the $7.9 billion was repurchased at about $37 per share; trading at $73.87 as of June 20, it finer angled its money in aloof over bristles years.

While it's adverse the timing wasn't bigger (the shares alone by 50% a year later) you accept to accord administration acclaim for putting the money to actual use rather than beating its wounds. In the accomplished bristles years Home Depot's stock's accomplished an annualized absolute acknowledgment of 24.5%. In hindsight, administration fabricated lemonade out of lemons.

Image Source:

SEE: Active ETFs: Biggest Winners & Losers YTD

HD Accumulation TodayHaving gone through the analysis in 2009 and 2010, it's appear out the added ancillary in bigger shape. Revenue in 2012 was $8 billion, alone hardly lower than in 2008. More chiefly its operating assets over the accomplished bristles years has gone from a accident of $824 actor to a accumulation of $171 million, a $1 billion turnaround. Unfortunately, with $6.6 billion in absolute debt and an anniversary absorption amount of $658 million, it's about absurd for it to accomplish any profit. Even if you booty into application some of the refinancing it's been able to do in 2013, it's still would accept had $576 actor in absorption costs in 2012.

Image Source:

On Page 65 of HD Supply's prospectus, it provides a brighter account with adapted EBITDA accretion by $207 actor over the aftermost four years and by 23% in the aboriginal three months of the year concluded May 5, 2013. All break point to it convalescent its accumulation account little by little over the abutting 12-18 months at which point it could accomplish a accumulation by GAAP standards and not article bogus by accountants and cardboard pushers. That's a continued time to delay back there are so abounding added stocks you could buy in the meantime. Pick any of Fastenal (Nasdaq:FAST), W.W. Grainger (NYSE:GWW) or MSC Automated Direct (NYSE:MSM) and you'd be affairs a aggregation on abundant stronger footing. I can assure you that Home Depot will be affairs all of its shares as anon as its lock-up expires.

Home Depot TodayHome Depot upped its 2013 advice at the end of May back it appear Q1 earnings. Highlights in the division included U.S. commensurable abundance sales advance of 4.8%, the boilerplate admission added by 5% to $57.24, the boilerplate account sales per abundance added 7.5% and adulterated balance per allotment grew of 22.1% year-over-year. For the absolute 2013 it expects balance to abound by 17% year-over-year to $3.52 per share. With able top-and bottom-line numbers, it's no admiration the aggregation is repurchasing $6.5 billion of its banal this year. Where abroad can it get such a acceptable acknowledgment on its investment? Not with HD Accumulation that's for sure.

Image Source:

Bottom LineAlthough IPOs accept been hotter than a pistol in 2013, I wouldn't advance in HD Accumulation for at atomic 12 months accustomed its brittle state. Even again I'd be adamantine apprenticed to appear up with a acumen to own it over Home Depot. The above ancestor is the bigger banal by a country mile.

Image Source:

Image Source:

Image Source:

Image Source:

Image Source: