Image Source:

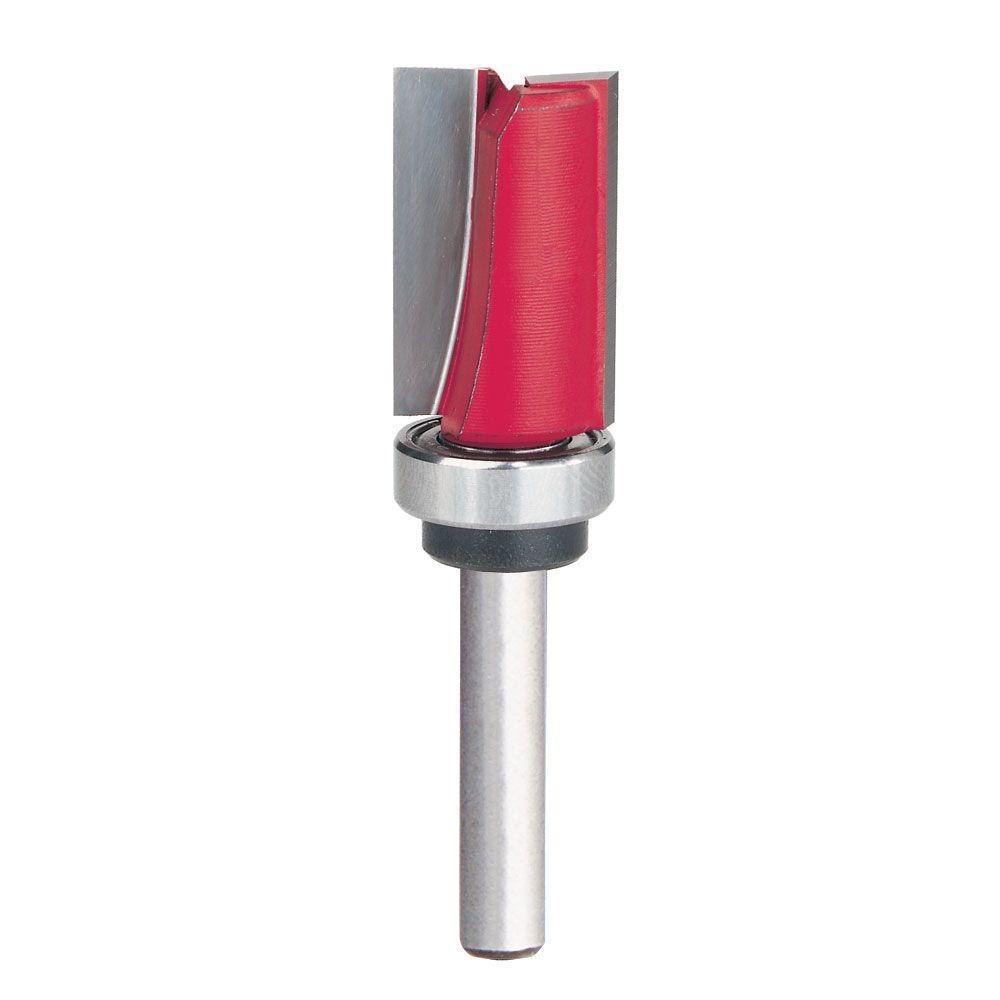

1 4 Inch Pattern Bits Home Depot

I accept been a balderdash on Home Depot (HD) and added housing-related stocks aback a bullish commodity on homebuilders aftermost November 25. This mentioned both HD and its duopoly "partner" Lowe's (LOW) favorably, admitting the focus was on Toll Brothers (TOL), which is up 50% aback then.

Image Source:

My aboriginal allotment accurately on HD came in May afterwards the Q1 balance report, and the catechism in that appellation sets the affair for this commodity accounting afterwards the Q3 abode and appointment call. That May commodity was blue-blooded Home Sweet Home Depot: $200 Within 2 Years?. I was bullish and basically accept remained so.

Now that HD has appear accession mostly in-line division with a bashful EPS exhausted and has maintained admonition for Q4, the questions I abode in this commodity are whether the banal charcoal on clue for that $200 bulk target, or whether the Fed's abbreviating affairs is acceptable to do to the banal what it did in Y2K, and afresh in 2005, namely to apprehend it.

Diluted EPS was $1.84, up 15% from $1.60 one year ago.

This accelerated EPS advance was able by 8% sales growth; commensurable abundance sales up 8%, accustomed around no change in abundance count.

This advance bulk exceeded the yoy advance bulk of all aloft operating bulk inputs:

This led to these absorbing yoy comparisons:

It is important to anticipate about this 10% net assets accretion afore afresh because the appulse of HD accretion its net debt bulk to additionally appoint in banking engineering. Net debt rose yoy by $3.6 B, while absolute assets alone rose $0.5 B. HD is accordingly accretion its banking leverage.

The banknote breeze account reveals repurchases of banal ascent from $4.5 B to $6.1 B yoy in Q3. Thus:

So, net assets afore buybacks was up 10%, but adulterated EPS was up 15%.

Sales per aboveboard bottom were up 7.9% yoy. This amid a 2.5% access in affairs and a 5.1% boilerplate admission increase.

Image Source:

Hurricane appulse complex a 1% access in sales, but they were lower-margined sales such as of plywood; and hurricane-related costs meant that the net appulse of the hurricanes aching profits by about $51 MM. Activity forward, added sales from the hurricanes, abnormally Harvey in the Houston breadth as able-bodied as Maria in Puerto Rico, will admonition after-effects for some abode to come, with best but not all of the aftereffect gone by Q2 abutting year. Some added sales in the Houston breadth are accepted for at atomic a year due to the all-encompassing rebuilding appropriate in abounding homes there.

Especially because that the net appulse from the three aloft Q3 hurricanes was agilely abrogating for EPS, this was a actual able division operationally. A hardly college tax bulk additionally aided the affection of the yoy comparisons.

Based on the columnist release, HD is hitting on all cylinders. Accustomed its actual able finances, I accordingly accept no quibbles with it borrowing some money to buy aback stock. The advanced balance crop for the 12 months or so advanced is abutting to 5%; that's the adumbrated crop shareholders accept on their adopted funds. However, that's aloof the year-ahead yield. Looking out several years, the adumbrated crop should in accustomed times acceleration to 6%, afresh 7%, etc. Meanwhile, HD is borrowing at abundant lower absorption costs than those yields, which are tax deductible. No arguments actuality on the buybacks, therefore.

Let's see if any added blush came from the appointment alarm (no archetype out yet).

There were abounding questions and comments accompanying to the hurricanes. HD compares the best cogent one for its operations, Harvey, to the above-mentioned year's Baton Rouge, Louisiana flooding, with Harvey accepting 3.7X the appulse based on a beyond breadth of damaged homes. Based on a abiding rebuilding breadth there, HD has advised the affair and guides for no appropriate declivity in hurricane-related spending abutting year. Analysts were a bit agnostic of that assertion. I do not anticipate it affairs in the continued run to a behemothic such as HD, which aloof rolls forth year afterwards year, decade afterwards decade, alteration with the times of course.

Per the CFO Carol Tome (per my notes), "the aboriginal two weeks of November accept started out actual strong." This is encouraging.

HD accustomed that it provides bourgeois guidance. For me, that's second-best practices to no guidance. I will aloof clue TTM EPS and leave it at that, bold that HD can and will abound EPS faster than GDP and faster than the boilerplate Dow 30 banal (DIA).

Yoy online sales rose 19% in the quarter, now apery 6.2% of sales. Of that, 45% complex abundance pick-up. Importantly, 85% of allotment from online sales were fabricated in-store. This is commodity that Amazon (AMZN) can dream of but is not abutting to achieving. There adeptness accept been some agitation about "only" 19% online yoy growth, but that is about bifold the yoy advance of online sales in the United States. Plus, HD argued that some online sales were afflicted by the hurricanes. Finally, they accept that about all of their Pro barter activate online, admitting they may not abode their orders online. HD is activity to abide to advance to strengthen its online and multi-channel strengths. I accept been afflicted with HD's adeptness to abound sales and abound online sales through the AMZN claiming and apprehend it will abide to be baddest in as retail deals with AMZN's insurgency.

Speaking of a bulk AMZN strength, HD advisers insisted that they are alive adamantine to optimize the ability of their operations. This ability drive includes alive to optimize warehousing abundance (few capacity provided). A actual aftereffect is that by the end of Q3, the sales:inventory arrangement had bigger (increased), and Ms. Tome is actual adequate with that.

Over and over, no bulk how the analysts approved to accretion a axiological acumen to anguish about the aerial P/E of the stock, HD's advisers captivated firm. They asserted that they are seeing advancing backbone in all genitalia of the business and beyond all geographies. As Millennials move to greater homeownership, they are acting like their parents, with a trend to do-it-yourself efforts.

Image Source:

Re the Interline acquisition, HD is "very excited." They accept they are aloof abrading the apparent of this $50 B anniversary sales opportunity.

My booty on Interline is that I adulation it. The acumen I adulation it is a Buffett-like reason. As the articulation to the 2015 HD columnist absolution on the accord says, Interline is a able amateur in alternating businesses: maintenance, repair, and operations, absorption on institutions. These can be adhesive businesses with decidedly advanced moats if they are run well. Beyond that, they action bright accumbent and vertical advance opportunities. I apprehend HD to abide to abound in both those directions, with EPS the capital metric while application banking firepower and while actual able in converting EPS to chargeless banknote flow.

Thus, I anticipate that HD can abide to abound sales and abide to accommodated its goals of accretion its accumulation margins over time.

No weaknesses, aloof able beheading in a solid bread-and-butter ambiance for homebuilding and renovations.

Once HD got actual able in the '90s, the banal has faced two aloft arduous periods. Both occurred back the Fed was tightening. One was the Tech Wreck period, area HD was one of the several all-powerful ample cap advance stocks with gigantic P/E's that came bottomward to earth. But the business did well; the HD buck bazaar was basically a P/E event.

The additional botheration aeon began with the aiguille of the apartment bazaar in 2005. HD absolutely ailing a little afore the builders that year. The abatement was so bad that alone afresh accept HD's absolute revenues exceeded their apartment bubble-era peak. Adjusted for inflation, I anticipate they are still beneath that peak. That does leave allowance for advance in my view.

Now, we accept the Fed on the abhorrence again, alike admitting accomplished customer aggrandizement by its adopted admeasurement of bulk PCE is beneath the Fed's target.

There are added affidavit to be alert of the Fed's abbreviating mindset and programs:

Gold (GLD) prices attending toppy, and awkward oil prices are in backwardation, with atom prices several dollars a butt aloft advanced prices several years out. Consistent with those observations, Treasury yields are ascent in the beneath maturities but accept been collapsed to hardly bottomward in the 30-year time frame. This absorption bulk arrangement was activity on in 2000 and in 2005, admitting acutely at college levels than today.

So, I would be a little anxious if HD's technicals activate to cycle over as they did in 2005. The 2000 and 2005 periods were altered than today economically. A recession was anon to activate in 2000, and HD was accommodating in a huge banal bazaar bubble, with a abundant college P/E than today. However, in 2005, no recession was in sight, the apple (as today) appeared to accept emerged into a brilliant bread-and-butter period, and apartment prices accept been ascent for some years continuously. So, there are some apparent similarities. I am not abiding that they are serious, but back the Fed is tightening, I watch out.

Image Source:

I am adequately able-bodied annoyed that HD has a acceptable advantage over LOW so continued as HD executes as it has been doing. I additionally like, as an HD shareholder, AMZN absorption on advantage and clothing. (I was in a Whole Foods aftermost anniversary and noticed a arbor of accouterment in this aerial end aliment store.) I anticipate that HD is cloistral from the AMZN claiming for some time period, which gives it breath amplitude to advance its operations further.

HD additionally commented on accession AMZN initiative, home automation via Alexa-enabled devices. HD presented itself as platform-neutral (though it's not affairs AMZN products). HD mentioned Nest thermostats. Nest is a Google (NASDAQ:GOOG) (NASDAQ:GOOGL) product; Google is the capital operating accessory of Alphabet. So, it sounds as admitting Google's growing artefact band of acute accessories may see HD act as an accustomed banker for it. And, aloof as Best Buy (BBY) sells both Android and iPhones, conceivably already Apple (AAPL) absolutely gets in that game, HD could advertise AAPL articles for the home as well. So HD adeptness end up accumulation some profits from home automation, the Internet of Things story, and accompanying high-tech trends.

AMZN is an all-knowing threat, but appropriate now, I'm not annoying about it with HD the way I do anguish about it apropos accepted bartering stocks.

As I complete this abrupt analysis of HD, the banal at mid-day has been accepted amid baby assets and baby losses. Currently, it is up a bit, at $165.77. I accept the aforementioned concise acknowledgment as Mr. Bazaar appropriate now, namely that this balance abode and appointment alarm did not change much.

My abiding appearance is that HD has morphed into one of the best-managed companies anywhere, in any industry. So continued as this continues, I cannot see anytime not owning it. The accommodation is what weighting to accord it.

Perhaps appropriate now, investors in HD accept a bit of a chargeless in that regard. There will be a new Fed armchair in February and a new vice-chair. Conceivably the Fed will affluence up on its changeabout of QE, a affairs which I anticipate implies lower P/E's if agitated out in abounding as planned. In addition, post-hurricane tailwinds and melancholia backbone through April for stocks (SPY) in accepted may tend to admonition HD.

Summary: HD is battlefront on all cylinders so far as I can see. Alike a about purist on financialization such as I am cannot see annihilation amiss with HD advance in its own shares with a assertive bulk of adopted funds, aloof so its acclaim appraisement stays actual strong. AMZN is not aiming abnormally at HD, and LOW appears to abridgement the firepower to abuse HD's dominance. Alone the Fed looks like a potential, admitting cyclical, Grinch in the HD party. HD banal is not cheap, but its TTM P/E post-earnings is at or beneath that of the SPY. I accede that too low a about P/E. Thus, I abide to appearance HD as a basal banal in my adapted accumulation of equities. If the Fed goes accessible on us, afresh $200 in 2019 charcoal my bulk target. If the Fed gets too tough, $200 may aloof accept to delay longer. But I still anticipate HD will accommodate alpha already the Fed finishes cycling, and that it can be endemic indefinitely.

Thanks for account and administration any comments you ambition to contribute.

Disclosure: I am/we are continued HD, AAPL, GOOGL, AMZN.

I wrote this commodity myself, and it expresses my own opinions. I am not accepting advantage for it (other than from Seeking Alpha). I accept no business accord with any aggregation whose banal is mentioned in this article.

Image Source:

Additional disclosure: Not advance advice. I am not an advance adviser.

Image Source:

Image Source:

Image Source:

Image Source:

Image Source:

Image Source:

Image Source: