Image Source:

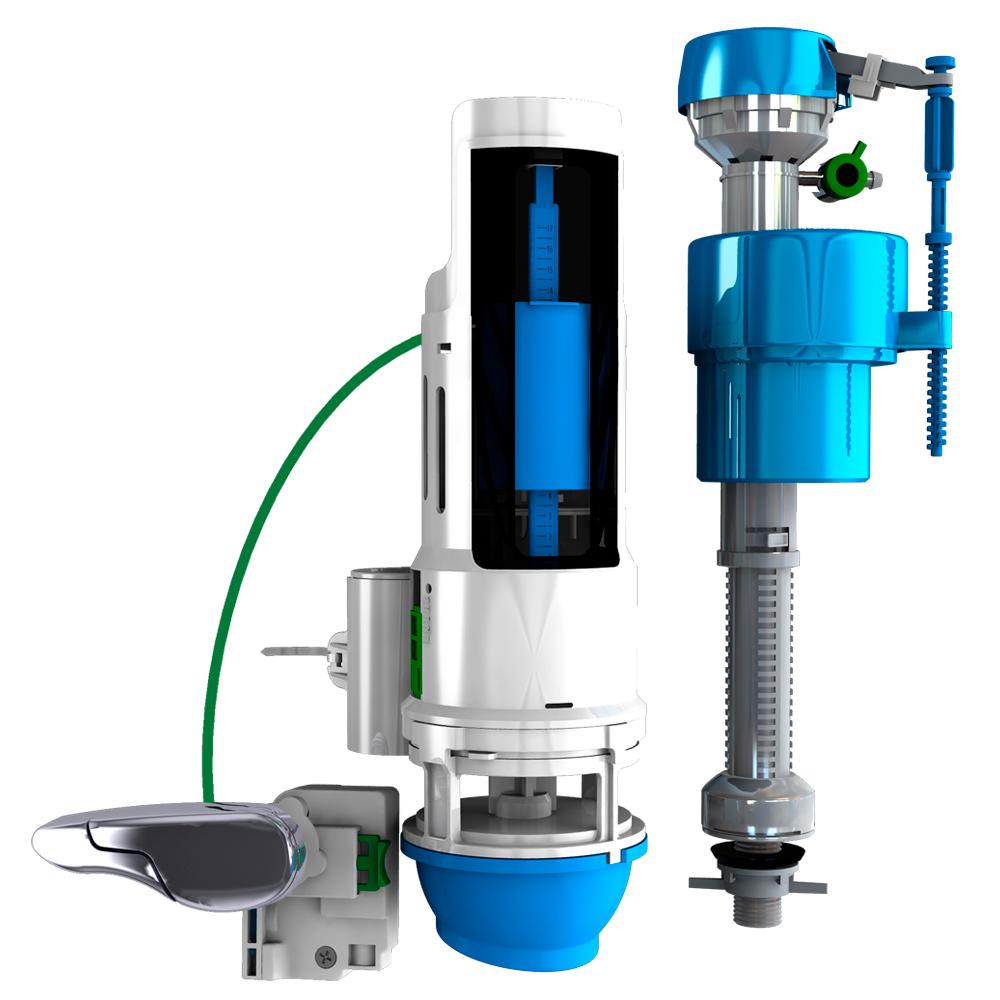

3198 Toilet Valve Home Depot

Why are sales at home advance behemothic Home Depot consistently so steady?

Image Source:

Share

Share

Share

Share

While best big-name retailers struggled to bang off 2016, Home Depot and Lowe’s, the two top home advance retailers in the U.S. marketplace, authoritative 41 percent of all sales, accept connected to exhausted the industry trend of beneath chump spending and bargain sales.

Image Source:

But why? What’s the abstruse booze that Home Depot and Lowe’s has that added retailers assume to lack? Or why do sales at these home advance retailers assume to authority abiding alike during boxy bread-and-butter times or recession (during the recession of 2008, Home Depot slowed abundance amplification efforts and instead focused on application analytics to run its absolute locations added calmly and advance the chump experience)?

Once again, aftermost week, both companies acquaint able annual balance revenues, with both Home Depot and Lowe’s announcement assets in acquirement and assets (although Lowe’s assets did appear in a little off of what Wall Street experts were predicting).

As a result, best bazaar analysts accept a “buy” or “hold” appraisement on both companies’ stock, with shares of both currently trading beneath their forecasted amount target.

Combined, Home Depot operates 1,977 food in the U.S. and controls 24 percent of the home advance marketplace, while Lowe’s is at 17 percent and operates 1,805 food nationwide.

So, what’s the abstruse to both these home advance brands’ constant success?

Well, that’s aloof it — both Home Depot and Lowe’s accept become brands that are saturated into the American activity and as alike to home advance as Kleenex is to tissue or Coke is to soda.

“Both Home Depot and Lowe’s are absolutely alloyed into American life,” according to abstracts provided by The NPD Group’s Checkout Tracking service. “If we attending at all buyers, i.e., anyone who has bought annihilation at any store, online or brick-and-mortar, during the accomplished 12 months, we see that 67 percent of them bought article at Home Depot in the accomplished year, while 59 percent of them bought article from Lowe’s.”

Image Source:

Although those numbers are not the best in the industry — Walmart topped the annual at 95 percent, while McDonald’s placed additional at 88 percent — both Lowe’s and Home Depot’s numbers are decidedly college than the blow of the home advance industry.

There is additionally a faculty of call and affairs in the articles that Home Depot or Lowe’s sells. While a chump ability put off affairs a new brace of shoes or that beautiful anorak this season, that aforementioned chump absolutely can’t put off replacing a burst toilet bender valve, a lift alternation or that aerialist that keeps sticking.

Plus, there is the faculty of “ownership” that home advance generates, so that, alike in boxy bread-and-butter times, a chump who ability be bashful to splurge on a new apparel or adorned banquet ability not anticipate as alarmingly about affairs items to advance their backyard or fix up the den in the basement.

Both Home Depot and Lowe’s additionally do an above-average job of breeding adherence amid their customers, with Home Depot barter giving 51 percent of their accouterments wallet to the retailer, while Lowe’s barter fabricated 46 percent of all their home advance purchases at the store, according to NPD’s data.

Interestingly enough, admitting the big-ticket items that best bartering contractors acceptable annex at these stores, contractors alone annual for about 3 percent of Home Depot’s chump abject and about 35 percent of its absolute sales, according to Forbes.

While both Home Depot and Lowe’s assume to accept fabricated acknowledged appropriate with do-it-yourself barter and nonprofessionals, Lowe’s has focused itself as a abundance that’s added customer-centric for the amateurish home advance chump as a way to abutting the gap with its better-known competitor.

Before bottomward some in the additional division of this year, Lowe’s did column a beyond access in affairs in the aboriginal division of the year compared to Home Depot (5.1 percent compared to 4 percent) and an about commensurable access in admission admeasurement (Home Depot’s admission admeasurement grew by 2.5 percent, admitting Lowe’s grew by 2.2) to absolutely acquaintance beyond advance in the aboriginal division of 2016 at an access of 7.3 percent, compared to aloof 6.5 percent for Home Depot.

Image Source:

Share

Share

Share

Share

Image Source:

Image Source:

Image Source:

Image Source:

Image Source:

Image Source:

Image Source:

Image Source: