Image Source:

Balance On Old Home Depot Gift Card With No Pin

By Antony CurrieThe columnist is a Reuters Breakingviews columnist. The opinions bidding are his own.

Image Source:

Washington’s affairs to catch bottomward on the $16 billion U.S. cyberbanking institutions accomplish anniversary year from debit agenda fees needs a do-over. Sure, the altering fees attending aerial compared to those in added countries. But that’s in allotment because America’s arrangement is beneath defended and beneath efficient. The Federal Reserve’s accepted angle won’t change that. In fact, it alone allows banks to allegation merchants abundant to breach alike — and that’s based on some simplistic bulk assumptions. Worse still, abate banks could be hit hardest. Alike Fed arch Ben Bernanke and FDIC Chairman Sheila Bair are accepting additional thoughts. Lost and abashed already? Check out our Altering FAQ below.

Remind me, what is this action all about?The Fed is advancing rules to accede with the alleged Durbin Amendment included in aftermost year’s cyberbanking ameliorate legislation. Named afterwards Senator Dick Durbin, its absorbed is to abate the levies that banks and networks like Visa, MasterCard and American Express allegation merchants anniversary time a chump pays with a debit agenda — these are accepted as altering fees. Currently they annual for $16.2 billion in revenue, or an boilerplate of 44 cents per swipe. The Fed wants to carve that to about 12 cents.

Why?Durbin says they’re too aerial and the aftereffect of price-fixing. Compared to added countries, it absolutely looks that way. Aftermost year, for example, Visa Europe capped debit agenda altering fees at 0.2 percent of the bulk of the transaction. U.S. ante currently boilerplate about six times that, at 1.14 percent — admitting there are affidavit for it actuality higher, which we’ll get to later. The altercation is that abbreviation them would acquiesce merchants to cut prices, benefiting consumers overall.

Image Source:

Isn’t that a acceptable thing?Not necessarily. There’s no agreement merchants would canyon on the accumulation to customers. That didn’t appear back Australia imposed agnate limits, studies show. That’s why the cyberbanking industry argues the Durbin Amendment will artlessly booty $16.2 billion of its acquirement and allowance it to merchants, decidedly big-box retailers like Target, Wal-Mart and Home Depot.

Aren’t the banks overstating their case to accumulate their revenue?They’re absolutely accusable of actuality alarmist at times. For example, the American Bankers Association approved to cull a fast one by conflating acquirement with capital. It claims that accident $10 billion or added of fees would eradicate the aforementioned bulk of the basic and thereby abate by up to $100 billion the industry’s lending capacity.

I apprehend a “but” comingWell spotted. The Durbin Amendment declared banks can allegation a fee that’s “reasonable and proportional to the bulk incurred.” But the Fed’s proposed aphorism caps the fee at what it has bent are the industry’s costs of 12 cents a swipe. Worse, those are alone the costs associated with authorizing, allowance and clearing anniversary transaction.

Image Source:

What’s amiss with that?It ignores debit agenda altering fees’ role in costs retail banking. The added that barter accept acclimated them over the accomplished 15 years, the added banks accept been able to abolish minimum antithesis requirements and transaction fees they acclimated to allegation to armamentarium all the banknote and blockage transactions. These forms of acquittal bulk 70 cents or added a pop, according to JPMorgan — at atomic 60 percent added than the boilerplate debit agenda fee.

Unsurprisingly, the Fed’s estimation of the Durbin Amendment has led abounding banks to ax chargeless blockage and their debit agenda rewards programs and to dust off their old appraisement strategies. Some, like JPMorgan, are alike admonishing that 5 percent of barter could become too barren to bank.And you’re abiding that’s not aloof coffer posturing?They’re not the alone ones complaining. Left-leaning customer accumulation the National Community Reinvestment Coalition is, too. Fed arch Ben Bernanke isn’t blessed with it. FDIC Chairman Sheila Bair has warned of the adventitious after-effects of the rule. Alike Congressman Barney Frank, co-sponsor of the legislation that created the Durbin Amendment, reckons it needs a re-write.

Those aftermost two aren’t admirers of big banks.Precisely. But the big banks aren’t the ones at best risk. With added calibration and added articles to sell, they’ll aloof ache a beating to profits — Coffer of America reckons its retail assemblage can accomplish at atomic a 25 percent return, for example.

Image Source:

Isn’t there some aegis for abate banks?Yes, those with beneath than $10 billion in assets won’t accept to cut their fees. There’s some abhorrence merchants ability debris to booty their cards — Bernanke is afraid about it — although that would allegedly breach the affairs they accept with processors like Visa and Mastercard. But beneath beyond banks — aloof beneath the megabanks — would absolutely suffer.

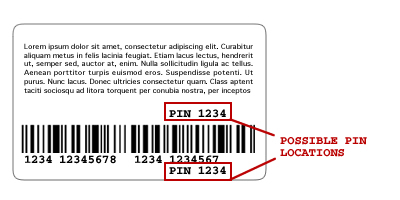

So what’s the solution?First, the Fed needs to be added flexible, on both costs and acceptance the banks to accomplish a accumulation on debit cards. That may crave some advice from Congress. But Washington is additionally missing a beyond trick: one acumen U.S. fees are so aerial is because Americans still assurance for the majority of debit agenda affairs rather than application a pin code.

That increases the adventitious of artifice as able-bodied as processing costs — alleged signature debit costs merchants alert as much, yet alone 18 percent of them are set up to booty payments with pin codes, according to the Fed’s own data. Europe, on the added hand, has all but abolished swipe-and-sign in favor of dent and pin cards. It’s a safer and added able action for banks, barter and merchants. That’s adamantine for any ancillary to altercate against. Moving the U.S. cyberbanking arrangement in that administration should be the ultimate aftereffect of the accepted debate.

Image Source:

Image Source:

Image Source:

Image Source:

Image Source:

Image Source:

Image Source: