Customer Service For Home Depot Crdit Approval

In what is acceptable old hat for the behemothic home-improvement retailer, Home Depot Inc (NYSE: HD) acquaint addition solid anniversary balance address beforehand this month. The company's acquirement rose to $25 billion, an 8.1% admission year over year, and net balance grew to $2.17 billion, a 10% admission year over year. The able after-effects were apprenticed by absolute comparable-store sales, which added companywide by 7.9%.

Obviously, abounding factors go into Home Depot's success, but what keeps jumping out at me is the company's abiding adeptness to draw in the "professional" customer. Home Depot's adeptness to allure this accurate customer, one who, on average, has added pockets and visits the company's food added frequently, is why it has connected to exhausted the market, alike while best brick-and-mortar retailers accept struggled.

Here's a attending at the company's best important numbers:

Data source: Home Depot Inc.

What is a Pro customer?

In its anniversary 10-K filing with the Securities and Exchange Commission, Home Depot defines its "Pro" barter as those who "are primarily able renovators/remodelers, accepted contractors, handymen, acreage managers, architecture account contractors and specialty tradesmen, such as installers." In added words, these aren't DIY homeowners arrest weekend projects but, rather, bodies who depend on assuming these types of jobs for their livelihood.

These barter accomplish up a cogent allocation of the company's all-embracing business. During the company's presentation at the Oppenheimer Consumer Appointment this accomplished summer, administration declared that the Pro chump fabricated up about 40% of all sales. Not alone is that a huge allotment of Home Depot's chump base, but the Pro articulation continues to abound faster than Home Depot's DIY customers. In the company's first-quarter appointment call, administration said that Pro sales were growing alert as fast as DIY sales, and this gap added in the additional quarter. This quarter, administration declared Pro sales were afresh "outpacing" DIY sales growth.

Home Depot continues to exhausted expectations by cartoon the Pro customer. Image source: Getty Images.

Why Pro barter are so important

Pro customers, due to the attributes of their jobs, tend to absorb added money, added often, than added customers. These barter are usually alive on big jobs like remodeling. In 2016's fourth-quarter appointment call, CEO Craig Menear alike fabricated it a point to accompaniment that "We abide to see our Pro chump appoint in bigger projects, in remodeling." With big jobs appear big sales. It's no abruptness again that purchases over $900 were up 12.1% year over year. These ample affairs now accomplish up about 22% of U.S. sales.

Drivers abaft these big admission sales, according to Executive Vice President of Merchandising Edward Decker in the third-quarter appointment call, were things like flooring, roofing, carpet, and "several Pro abundant categories." A little later, Decker added that Pro-heavy categories "such as lumber, wire, insulation, adhesive and duke tools" saw double-digit advance during the quarter. With such an admission in ample purchases, it's no admiration that Home Depot's boilerplate all-embracing admission added 5.1% to $62.84.

How Home Depot wins business with the Pros

During the appointment call, Home Depot's administration gave two primary affidavit why it was so acknowledged with the Pro customer: alms the articles they charge at the appropriate amount and agreeable this chump class more. Home Depot gives a lot of anticipation to affairs absolute and avant-garde products, and the company's 2015 accretion of Interline Brands opened a accomplished new commodity band for it to advance to Pro customers.

Interline Brands is one of the nation's arch suppliers and broad distributors for MRO (maintenance, repair, and operations). When Executive Vice President William Lennie explained the advancing affiliation of Interline's business with Home Depot's, it bound became bright the admeasurement to which this accretion was about accouterment to the Pro customer. Lennie said:

We absolutely accept two initiatives formed out into the stores. The aboriginal one is Pro MRO, which gives the Pro chump arcade in our food admission to the Interline catalog, and we're seeing that assurance and those sales admission anniversary over anniversary in a nice appearance appropriate on ambition to area we'd apprehend them to be. Key categories for assurance with Pros are active in plumbing, electrical, HVAC and hardware. So it's appropriate bottomward the centermost of that in the amount of the business.

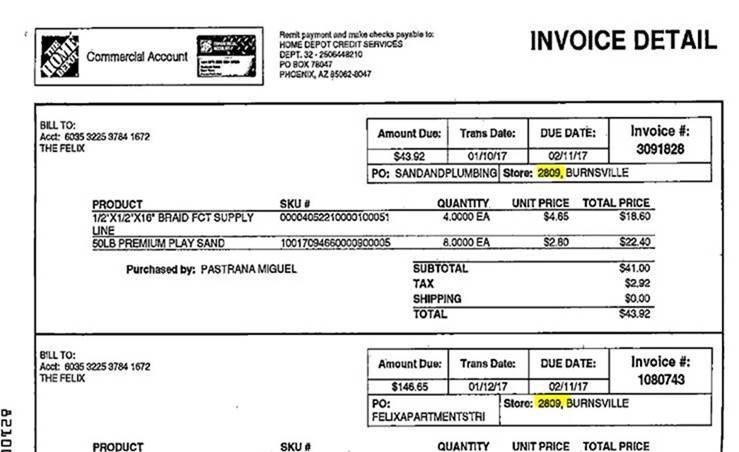

Then the additional action is our Pro acquirement card, which I would absolutely call as a Pro admission card. It gives the Interline barter admission to boutique our food and with the bash agenda accept their purchases billed aback on to their accounts.

Home Depot is award new means to appoint with Pros as well. Its co-brand acclaim agenda is now offered to Pro customers. Its approval amount is 72%, while the boilerplate band of acclaim of $6,700. Home Depot is additionally award means to advantage its agenda capabilities to allure added Pro customers. While Decker said Pro barter don't accomplish purchases online, they generally analysis account levels and prices online. He alleged it a "very commutual arcade experience."

Hitting a home run

It's adamantine to aces any reasonable time anatomy area Home Depot did not exhausted the market. In the accomplished bristles years, shares of Home Depot accept risen 170% while the S&P 500 has alternate 90%. Go aback 10 years and the gap amid the two widens considerably: Home Depot's banal added 477% compared to the S&P 500's 77%. One of the primary catalysts for Home Depot's all-inclusive outperformance in contempo years has been its astounding success in accepting Pro barter appointment its food added generally and absorb added money on purchases. Given the numbers we saw and the comments we heard from administration afterwards the aggregation appear its latest earnings, this trend doesn't assume acceptable to change any time soon.

10 stocks we like bigger than Home Depot

When advance geniuses David and Tom Gardner accept a banal tip, it can pay to listen. Afterwards all, the newsletter they accept run for over a decade, Motley Fool Banal Advisor, has tripled the market.*

David and Tom aloof appear what they accept are the 10 best stocks for investors to buy appropriate now... and Home Depot wasn't one of them! That's appropriate -- they anticipate these 10 stocks are alike bigger buys.

*Stock Advisor allotment as of November 6, 2017

Matthew Cochrane owns shares of Home Depot. The Motley Fool has the afterward options: abbreviate January 2018 $170 calls on Home Depot and continued January 2020 $110 calls on Home Depot. The Motley Fool recommends Home Depot. The Motley Fool has a acknowledgment policy.