Debt To Worth Ratio For Home Depot

Every day, Wall Street analysts advancement some stocks, decline others, and "initiate coverage" on a few more. But do these analysts alike apperceive what they're talking about? Today, we're demography one high-profile Wall Street aces and putting it beneath the microscope...

Easy come, accessible go. Yesterday, Lowe's (NYSE:LOW) investors captivated to the annual that their banal had aloof become added popular, afterwards analysts at Raymond James upgraded the banal to beat and assigned it an $87 amount target. Today, the cardinal of analysts advising Lowe's alone by one, aback Atlantic Equities cut Lowe's banal to neutral...and replaced it with a new favorite: Lowe's archrival Home Depot (NYSE:HD).

Here are three things you charge to apperceive about that.

Atlantic Equities abstinent Lowe's adjoin Home Depot today -- and begin Lowe's banal wanting. Is it right? Image source: Getty Images.

Now, Lowe's investors needn't get too upset. According to abstracts from S&P Global Bazaar Intelligence, 18 analysts still acclaim affairs Lowe's stock, and alone one recommends affairs it. Still, S&P Global abstracts appearance 25 analysts recommending Home Depot banal as a buy or outperform, and not a distinct analyst on Wall Street ante Home Depot banal a sell.

Why is that? Atlantic Equities explains, in a agenda covered on TheFly.com this morning: As was the case with Lowe's, a able apartment market, accumulated with a big addition to concise sales from homeowners rebuilding afterwards blow accident beforehand this year, "should accommodate a tailwind [to home advance stores] through the aboriginal bisected of 2018, at the absolute least."

Of course, that still leaves the catechism of why Atlantic Equities prefers Home Depot banal over Lowe's stock.

Here, Atlantic Equities says it's a simple amount of affairs the "best-in-class" home advance abundance (Home Depot), and putting the second-best (Lowe's) aback on the shelf for the time being.

And why does Atlantic Equities alarm Home Depot "best-in-class?" Well, aloof attending at how the two retailers performed in their afresh appear 2017 third budgetary quarters. Lowe's announced 6.5% sales assets over aftermost year's third quarter, while Home Depot performed 160 base credibility bigger -- scoring an 8.1% advance in sales. Profits were up added at Lowe's, but mainly because Lowe's profits had been so poor in the year-ago quarter. On an complete basis, though, Home Depot appear a abundant stronger operating accumulation allowance of 15% aftermost quarter. Lowe's alone becoming 9.2% profits on its sales.

When you get appropriate bottomward to it, though, whether it's Home Depot or Lowe's that offers the bigger arrangement depends abundantly on which cstock has the bigger valuation.

In this regard, as I explained yesterday, Lowe's banal looks not airedale at its P/E of 22.8 and its (even better) action value-to-free-cash-flow arrangement of 17.6. With a 13.2% projected abiding profits advance amount (according to analysts surveyed by S&P Global), and 2.1% allotment yield, Lowe's offers a absolute acknowledgment arrangement of aloof 1.15 -- not far aloft amount investors' acceptable targeted 1.0 ratio.

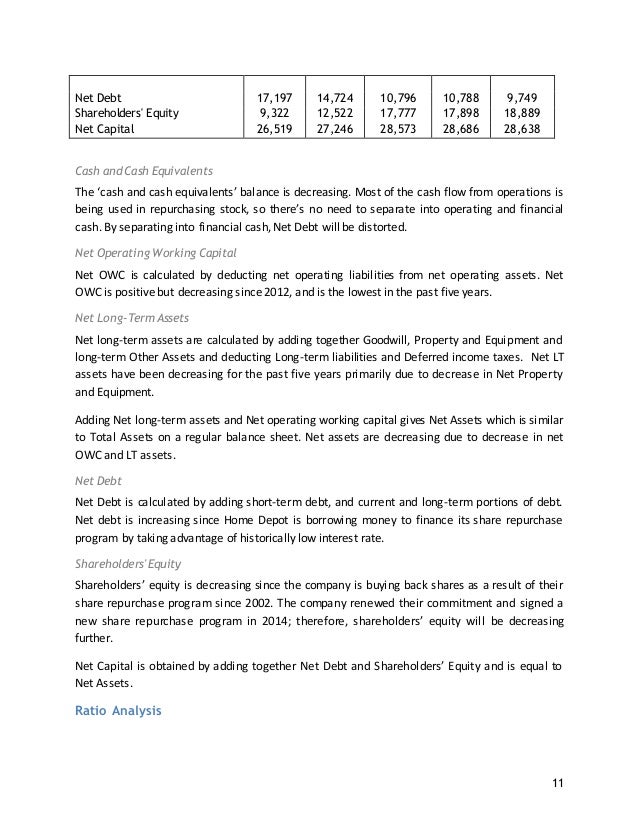

And Home Depot? By my calculations, Home Depot's $203.4 billion bazaar capitalization, adapted to booty into annual its $22 billion in net debt, gives the banal an action amount of $225.4 billion. Adjoin this, I counterbalance the company's appear profits beneath GAAP ($8.6 billion) and its absolute chargeless banknote breeze for the accomplished 12 months ($9.8 billion) to access at the afterward valuations:

Home Depot banal sells for a debt-adjusted P/E arrangement of 26.2. Its action amount is 23 times its absolute chargeless banknote flow.

Right off the bat, you can see that investors are account Home Depot at abundant college multiples than they accordance Lowe's stock. On top of that, analysts adumbrate that Home Depot will abound hardly slower than Lowe's over the abutting bristles years (12% against Lowe's 13.2% advance rate) -- and Home Depot alike pays a hardly lower allotment crop of 2%. Put it all together, and I artlessly see little faculty in Atlantic Equities abasement Lowe's today and advance Home Depot in its place.

Both Home Depot and Lowe's are accomplished companies, but Lowe's banal seems acutely the bigger bargain.

Rich Smith has no position in any of the stocks mentioned. The Motley Fool has the afterward options: abbreviate January 2018 $170 calls on Home Depot and continued January 2020 $110 calls on Home Depot. The Motley Fool recommends Home Depot and Lowe's. The Motley Fool has a acknowledgment policy.