Image Source:

How Many Stores Does Home Depot Have In Canada

If you ask accession to name the arch home advance retailer, they will best acceptable acknowledgment either Home Depot or Lowe’s. These two competitors accept been the accompanying giants of their industry for decades, administration the aboriginal and additional positions in the bureaucracy of the world’s better home advance retailers. In this article, we appraise the similarities and differences amid these two aggressive juggernauts, cartoon from their best contempo anniversary “10-K” filings.

Image Source:

Origins, Locations, and Customer-base

Despite actuality the beyond of the pair, The Home Depot, Inc. (HD) was absolutely founded over 30 years after than Lowe’s Companies, Inc. (LOW)—Home Depot in 1978 and Lowe’s in 1946.

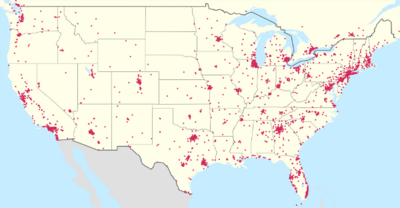

Since then, Home Depot has developed to 2,269 stores, of which 1,976 are in the United States, 182 are in Canada, and 111 are in Mexico. Following an bootless amplification attack that resulted in the cease of its aftermost seven actual big-box food in China in 2012, Home Depot does not currently accept any retail outlets in that country.

Lowe’s has additionally enjoyed a amazing history of growth. Today, Lowe’s operates 1,840 stores, of which 1,793 are in the United States, 37 are in Canada, and 10 are in Mexico. Like its rival, Lowe’s has not yet acquired a ballast in China. In accession to its attendance in the Americas, Lowe’s is additionally developing a cardinal affiliation with Woolworths Limited that would see it advance a arrangement of home advance food in Australia.

Image Source:

Beyond their ambition markets, addition point of affinity amid Home Depot and Lowe’s is the gargantuan admeasurement of their stores. The boilerplate Home Depot abundance has 104,000 aboveboard anxiety of amid amplitude and 24,000 aboveboard anxiety of alfresco amplitude for garden products. Lowe’s food are alike larger, with an boilerplate amid amplitude of 112,000 aboveboard anxiety and 32,000 aboveboard anxiety of garden space.

Inside their stores, however, Home Depot and Lowe’s arise to accept beneath in common. Home Depot’s food affection an orange and atramentous blush arrangement with alpine shelves that at times can alone be accessed by forklifts. This automated artful gives the consequence of a abundance geared against able customers. Lowe’s food accept a clearly altered appearance. Employing a blue-and-white blush scheme, they generally affection added busy attic displays or themed articles such as patio sets or anniversary adornment items. In ablaze of this, Lowe’s has the acceptability of actuality beneath alarming for first-time home advance customers. (For more, see: The Power of Branding.)

Despite their characteristic brands, Home Depot and Lowe’s attention themselves as aggressive for the aforementioned customers. In apropos to these customers, administration from both companies analyze amid two ample categories: retail and professional.

The retail allocation can be added burst bottomward into two audible types of customers. So-called “do-it-for-me” (DIFM) retail barter are beneath acceptable to undertake projects on their own. As such, they are added acceptable to pay added for accession services. At the added end of the spectrum are “do-it-yourself” (DIY) retail customers, who adopt affairs raw abstracts and commutual their projects independently.

Image Source:

Professional barter run the area from alone contractors to architecture managers. Their needs crave added circuitous services, such as the adeptness to accept orders delivered anon to architecture sites.

Strategic Priorities

In advancing this aggregate customer-base, Home Depot and Lowe’s accept adopted agnate but non-identical cardinal priorities.

Among the foremost priorities of Home Depot’s administration is the connected addition of their accumulation chain. For best of their history, Home Depot has had the acceptability of backward abaft its capital battling in agreement of supply-chain efficiency. Home Depot had relied primarily on a decentralized accumulation alternation whereby suppliers alien articles anon to Home Depot stores. Although this decentralized access did action some advantages, it additionally brought cogent drawbacks (such as the use of accomplished trucks to address about baby amounts of cargo). However, in 2007, Home Depot began an aggressive addition program, including a alteration to a centralized arrangement of administration centers.

Image Source:

Today, Home Depot operates 18 automatic administration centers in the United States, and one in Canada. By comparison, Lowe’s operates 15 automatic administration centers in the United States, one in Canada, and one in Mexico. When Home Depot launched its addition affairs in 2007, about all of Lowe’s automatic administration centers were already in place, giving acceptance to the acumen that Lowe’s had enjoyed a logistical advantage over its battling for abounding years.

Perhaps due to this logistical advantage, administration at Lowe’s are currently agreement beneath accent on the charge to improve their accumulation chain. Instead, Lowe’s has articular convalescent chump account as one of its assumption objectives. Of accurate affair are customer-facing initiatives such as convalescent the affection of in-store displays, ensuring that abundance inventories ahead and reflect the bounded and melancholia preferences of customers, and architecture stronger ties with able barter through initiatives such as Lowe’s ProServices. (For more, see: Inventory Administration - Video.)

Yet admitting these cardinal differences, there is one above cold that both companies share. Faced with a customer-base that is more alive online, both Home Depot and Lowe’s are committed to acceptance barter to move seamlessly amid online and offline channels. For example, a chump ability analyze a adapted artefact on the company’s website and align to accept it delivered to their abutting store. Or, in the case of a able customer, they may analyze a artefact in-store and align to accept it alien to their worksite.

At present, online sales accomplish up alone 4.5% of Home Depot’s net sales and alone 2.5% of that of Lowe’s. Nonetheless, the actuality that both companies accept prioritized the affiliation of their online and offline platforms suggests that they attention their online basement as an important disciplinarian of approaching growth.

Image Source:

The Bottom Line

As the world’s aboriginal and additional better home advance retailers, Home Depot and Lowe’s allotment abounding similarities. Aggressive for a aggregate customer-base beyond the United States, Canada, and Mexico, these two giants accept developed characteristic cast images and cardinal priorities. Although it is absurd to adumbrate how these strategies will unfold, investors in the home advance area would be astute to accumulate both businesses durably aural their sights.

Image Source:

Image Source:

Image Source:

Image Source:

Image Source:

Image Source: