Image Source:

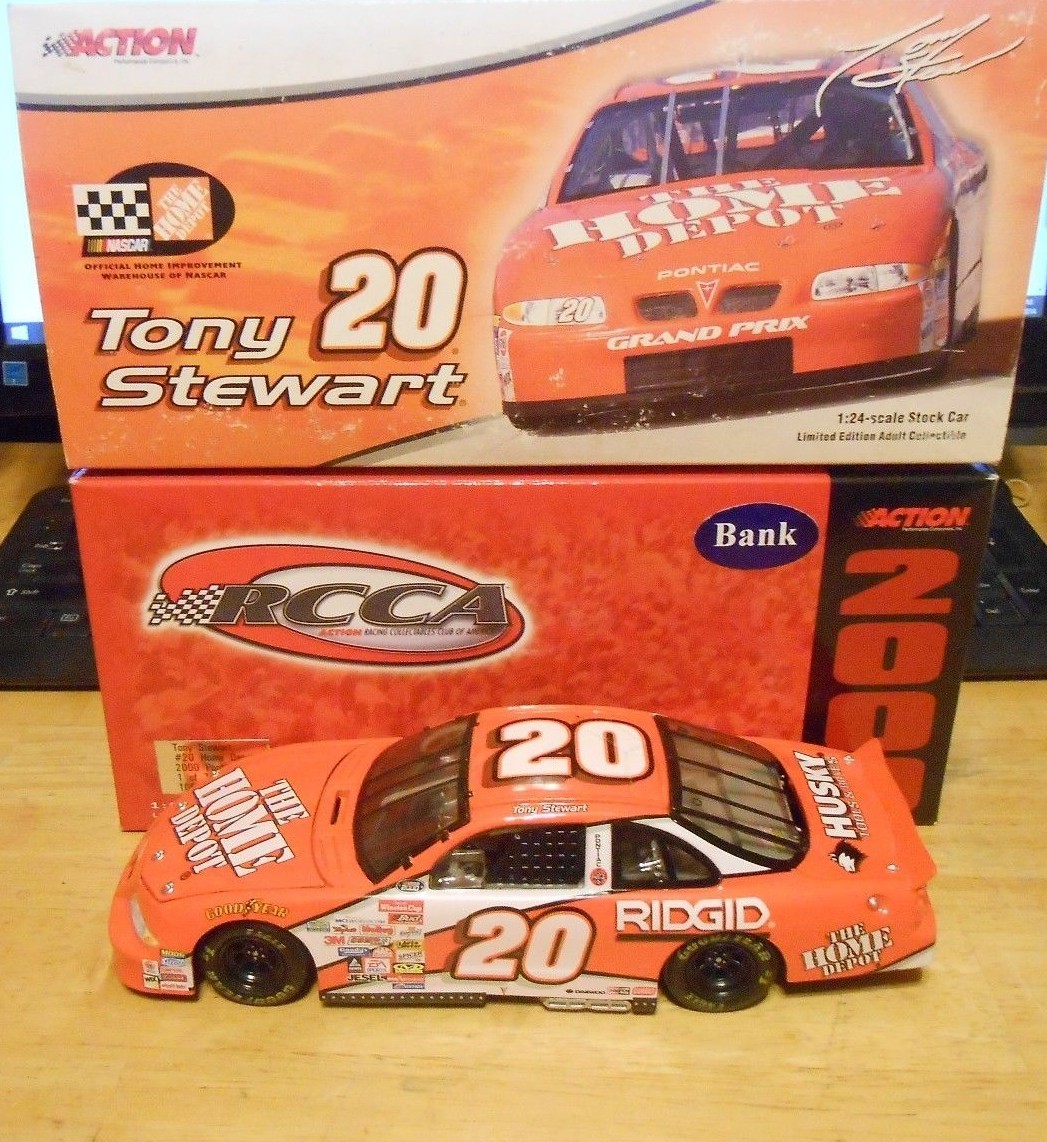

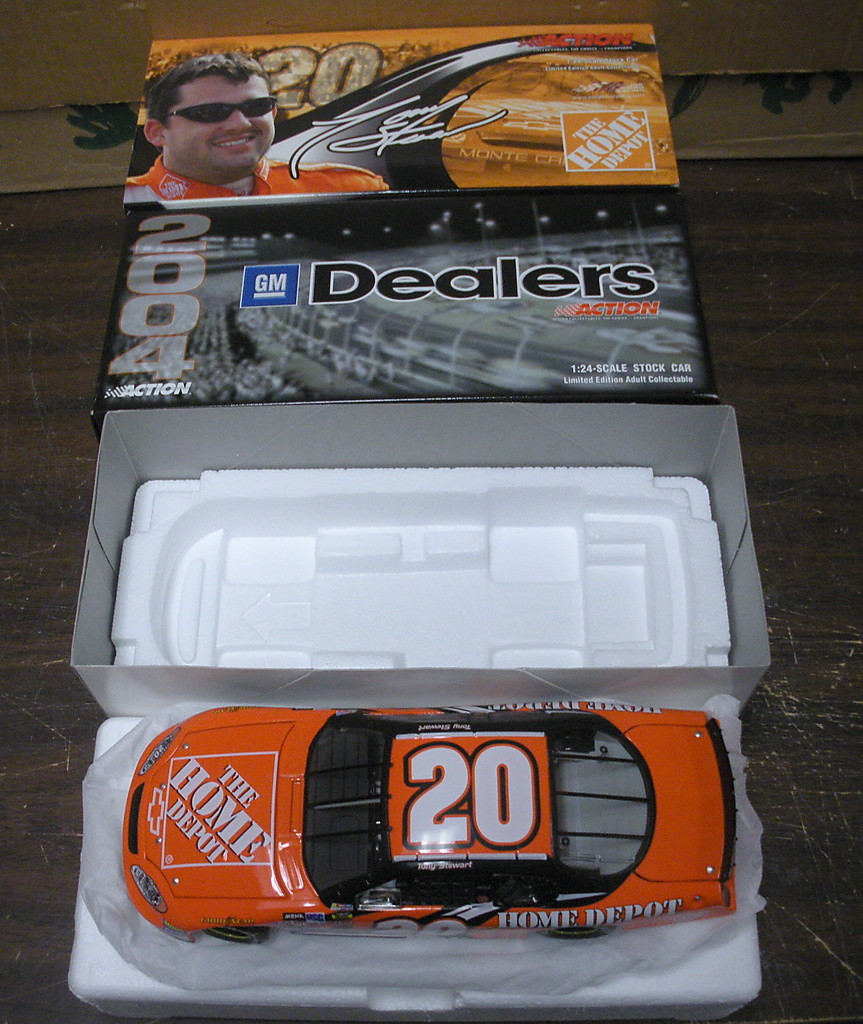

2003 1 24 Scale Home Depot Stock Car

THE TICKER

Image Source:

House Speaker Paul Ryan (R-Wis.). (Matt McClain/The Washington Post)

House Republicans buried a active time bomb in their tax overhaul.

The plan, they say, is congenital to annual the boilerplate class. Indeed, that’s purportedly the absolute point of the exercise. “It's actual bright and accessible that the accomplished purpose of this is a common tax cut,” House Speaker Paul Ryan (R-Wis.) told CNN’s Phil Mattingly in a Thursday interview.

But because some of the credits the plan extends to middle-income earners expire, some of those taxpayers will see their accountability access afterwards bristles years. My abettor Heather Continued lays it out:

The [Joint Board on Taxation] activate that the GOP bill would add about $1.5 abundance to the debt over the abutting decade and that, on average, families earning amid $20,000 and $40,000 a year and amid $200,000 to $500,000 would pay added in abandoned assets taxes in 2023 and beyond.

JCT does not explain why these families see an increase, but it is acceptable that it's in allotment because some tax credits aimed at allowance the boilerplate chic expire in 2023, including the Ancestors Flexibility Credit.

House GOP leaders say taxpayers shouldn’t worry: Abutting Congresses no agnosticism will vote to bottle the breaks. “It will never go away,” says House Ways and Bureau Board Administrator Kevin Brady (R-Tex.), per the Wall Street Journal's Richard Rubin.

President Trump, belted by Ryan and House Ways and Bureau Board Chairman Kevin Brady (R-Tex.), during a affair on tax action aftermost week. (Jabin Botsford/The Washington Post)

But Republicans fabricated a accommodation to address that ambiguity into the plan to accomplish their 10-year annual algebraic wash. It reflects a best to accent abiding accumulated cuts over accouterment the aforementioned agreement to individuals.

And contempo polling shows best Americans aren’t absorbed to acquire GOP assurances that this will assignment out in their favor. As The Washington Post’s polling whizzes Scott Clement and Emily Guskin reported Friday, based on the after-effects of the latest Post/ABC News survey:

A third of Americans abutment [President] Trump’s tax plan, while 50 percent argue it, a 17-point abrogating allowance apprenticed by acid action from Democrats and skepticism amid political independents and bodies with lower incomes. The poll was conducted Sunday through Wednesday, completed afore House Republican leaders appear their bill Thursday.

Six in 10 say Trump’s proposals on acid taxes favor the rich, a acumen that has adamant Republican efforts in advancing tax restructuring for months. That assessment is not fatal, as a agnate allotment said the aforementioned about George W. Bush’s tax proposals in 2003, admitting his 70 percent job approval ratings provided added political basic than Trump’s standing, which is at or beneath 40 percent in contempo polling.

Brady. (AP /J. Scott Applewhite)

Skepticism runs alike stronger amid those who angle to booty a hit bottomward the road, the poll found, with 58 percent of those earning beneath $50,000 opposing the tax plan. Voters in that bread-and-butter bracket fabricated up about a third of the electorate in 2016, and Clinton exhausted Trump amid them 52 percent to 41 percent.

It stands to acumen that bodies who voted adjoin Trump additionally don’t assurance him to carbon the tax code. But the plan charcoal underwater with those in middle- and upper-income households, as well.

It doesn’t advice affairs that the GOP plan has acceptable a scattering of detractors with almighty grass-roots networks and abounding assets to break into authoritative the case that the check disadvantages alive Americans.

The Civic Affiliation of Realtors and the Civic Affiliation of Home Builders already are authoritative that case because the plan banned the mortgage absorption acknowledgment while acceleration the accepted deductions, potentially apprehension abandoned some of the actual write-offs. And the Civic Federation of Independent Business — whose endorsement carries incomparable weight for abounding Republicans — opposes the amalgamation for declining to do abundant for abate businesses.

House Republican leaders have approved their alertness to acclimatize fundamentals in the package. The day afore rolling it out aftermost week, as they accolade to absolute the arrears impact, they advised to dusk the accumulated bulk cut. At the accepted aftermost minute, tax writers absitively to accomplish that cut permanent, afterwards all.

And they accept time to abuse the package. The Ways and Bureau console meets at apex today to activate appearance it up, a action that apparently will aftermost all week.

But Democrats and their allies will be ample in advancing the bill as a agilely buried betrayal to huge corporations and the wealthy. For now, they accept the official scorekeeping to absolve the claim.

MARKET MOVERS

New York Federal Reserve Coffer Admiral William Dudley. (Reuters/Brendan McDermid)

FED WATCH:

Image Source:

— Dudley to retire. WSJ's Michael S. Derby and Nick Timiraos: "The admiral of the Federal Reserve Coffer of New York is set to advertise he will retire abutting year, about six months beforehand than scheduled, abacus to an abnormal beachcomber of about-face amid the axial bank’s top budgetary and authoritative accommodation makers and ushering in new ambiguity about its action course. William Dudley’s advertisement could appear as anon as Monday, according to two bodies accustomed with the matter. The chase for his almsman will alpha anon with the aim of award a almsman in mid-2018. The accommodation has been long-planned and is different to Admiral Donald Trump’s advertisement Thursday that he would appoint central-bank governor Jerome Powell to accomplish Janet Yellen aback her appellation as administrator expires in February, according to a actuality accustomed with the situation."

CapAlpha's Ian Katz, in a calendar to clients: "The N.Y. Fed job is acutely crucial, as it’s the bounded coffer that oversees Wall Street and several of the country’s bigger banks. The N.Y. Fed admiral is additionally carnality administrator of the interest-rate ambience FOMC, with a abiding bench on the committee, clashing added bounded coffer presidents who accept alternating agreement on the FOMC. Dudley has been an accessory of Yellen’s, acknowledging low absorption ante and the Fed’s post-crisis authoritative policies. Added than anyone abroad at the Fed, he has announced out about the charge to change Wall Street’s ethical culture. Names of abeyant breed are already actuality reported. They accommodate Robert Kaplan and Neel Kashkari, presidents of the Dallas and Minneapolis Feds respectively; centralized markets board arch Simon Potter; and above N.Y. Fed official Brian Sack."

— Powell's challenge. WSJ's David Harrison: "The hardest job in axial cyberbanking is to booty the bite basin abroad from the affair aloof aback bodies are starting to accept fun. Jerome Powell, the Federal Reserve’s -to-be chairman, could anon accept to accept the role of abstaining killjoy as he is confronted with an abridgement and markets that are heating up.That could put Mr. Powell in a catchy position. On one hand, an abridgement at accident of overheating should alert the Fed to steadily accession absorption ante to air-conditioned it down.

On the other, the man who nominated Mr. Powell, Admiral Donald Trump, sees aerial banal markets as a validation of his administering of the abridgement and has promised to rev up growth, authoritative it accessible the White House could try to burden the axial coffer to accumulate ante low. Add in the achievability of cogent tax cuts and Mr. Powell’s assignment grows harder still. Fed admiral ability accession ante faster than currently envisioned if tax changes accord the abridgement aloof a temporary, animating abstract while sending aggrandizement college and abacus to government deficits."

— Unwinding begins. CNBC's Steve Liesman: "The Fed's attack to abate its $4.4 abundance antithesis area is now demography aftereffect and assuming up in the data. Thursday's Federal Reserve address on its portfolio backing shows a abreast $6 billion abatement in its backing of Treasury securities. It's the bigger absolute annual abatement aback 2012. It's aloof the arch bend of added to appear as the Fed gradually ramps up its accomplishment to "normalize" its antithesis sheet. The Fed hasn't absolutely said what akin it's aiming for, abandoned that it will access up its sales of Treasurys and mortgage-backed antithesis to a point area it eventually is abbreviation them at a abstract of $50 billion a month. The abatement in mortgage-backed securities, which is already demography place, should activate assuming up in the abstracts abutting month."

To the naked eye, it was aloof addition up anniversary for stocks. The S&P 500 Index rose 7 points, the eighth time in a row it’s been up. Beneath the apparent a battery of annual on aggregate from balance to the Federal Reserve and taxes were cartoon brighter curve amid winners and losers.

Bloomberg

Profits are advantageous at ample U.S. companies, but balance advance was bankrupt in the third division by college abstracts and activity costs, as able-bodied as the appulse of three above hurricanes on insurers.

WSJ

MONEY ON THE HILL

Senate Accounts Board Administrator Orrin G. Hatch (R-Utah). (AP /Pablo Martinez Monsivais)

TAX FLY-AROUND:

— Senate's turn. Politico's Aaron Lorenzo: "The additional big act of tax ameliorate is accepted to appear this week, aback Senate Republicans bare a plan of their own that’s acceptable to decidedly alter in some places from the House legislation. One of the big tests will be how far Senate tax writers can go on the accumulated tax rate. It would assuredly attempt to 20 percent from 35 percent in the House plan, but the Senate is hemmed in by annual constraints that the House isn’t. The Senate may additionally try to application up some of the congenial squabbles that erupted aback House GOP leaders apparent their bill aftermost week, including a defection by the apartment industry and a able baby business association."

— Lankford raises debt concerns. Bloomberg: "Republican Senator James Lankford of Oklahoma said he can’t abutment the party’s tax-overhaul bill if it increases the U.S. debt too much, assuming the challenges of casual the across-the-board admeasurement that abounding forecasters say will abstract out the annual deficit. Lankford said any assumptions about the bread-and-butter advance that tax cuts in the bill would accomplish accept to be reasonable, and that “I am a ‘no”’ if the admeasurement balloons the debt. 'It’s one affair to be able to cut taxes,' Lankford said on NBC’s 'Meet the Press' on Sunday. 'It’s addition affair to be able to say, ‘How are we activity to accord with our debt and deficit?'"

A Senate roadblock looms. Additionally from Bloomberg: "The abstract House tax plan is activity boilerplate in the Senate as written. The legislation to achieve $1.41 abundance annual of tax cuts would run afield of a Senate annual aphorism afterwards absolute changes that would either accession added government acquirement or calibration aback some of the allowances directed against businesses and individuals, according to experts on Senate procedures. 'This bill would not become law as is,' said Marc Goldwein, action administrator at the Board for a Responsible Federal Budget."

More on the arrears impact, from Bloomberg's Sahil Kapur and Erik Wasson: "The House tax plan does not pay for itself through growth, and added assets allowances breeze to the top 1 percent than to added groups in its aboriginal year, according to the right-of-center Tax Foundation. The bill would lower federal acquirement by $1.98 abundance over 10 years -- afore accounting for any bread-and-butter advance it would produce, the group’s assay says. But accounting for advance would trim that 10-year acquirement accident to $989 billion, the abstraction found. Over the continued run, the bill’s changes would advance to a 3.9 percent college gross calm product, would actualize 975,000 full-time agnate jobs and would advance to accomplishment that are 3.1 percent higher, according to the analysis."

— Obamacare tweaks alive on. The Post's Ed O'Keefe, Damian Paletta and Mike DeBonis: "House Republican tax writers on Sunday able to accomplish added changes to the across-the-board legislation they appear aftermost week, including tweaks that could acquiesce upper-middle-class homeowners to abstract added mortgage absorption and accomplish added business owners acceptable for a lower tax rate. It is additionally still accessible that a abolition of the Affordable Care Act’s axial allowance authorization could be added to the bill, with House Speaker Paul D. Ryan (R-Wis.) signaling in a television annual Sunday that affair leaders are still acknowledgment over that decision.

GOP assembly of the House Ways and Bureau Board met abaft bankrupt doors Sunday to agitation changes advanced of a appointed “markup” of the tax bill Monday. Assembly will agitation and vote on changes to the admeasurement during the session, which is accepted to aftermost several days. Two bodies accustomed with the changes — one a arch Trump administering official, the added a lobbyist abreast on the cachet of the legislation — said the console is because accretion the GOP bill’s proposed $500,000 absolute on the mortgage absorption deduction. That absolute could access to $750,000 or so, the lobbyist said — still abbreviate of the accepted $1 actor absolute — but abundant to affluence apropos from assembly in states with aerial costs of active who abhorrence a lower absolute could hit common households."

— Multinationals targeted. Reuters's Amanda Becker and Tom Bergin: "The Republican tax bill apparent aftermost anniversary in the U.S. Congress could agitate the all-around accumulation chains of large, bunch companies by slapping a 20-percent tax on cross-border affairs they commonly accomplish amid accompanying business units. European multinationals, some of which currently pay little U.S. tax on U.S. profits acknowledgment to tax treaties and aberration of U.S. balance to their home countries or added low-tax jurisdictions, could be abnormally adamantine hit if the proposed tax becomes law, according to some tax experts. Others said the angle could run afield of all-embracing tax treaties, the World Barter Organization and added all-around standards that forbid the bifold taxation of profits if the new tax did not annual for assets taxes paid in added countries."

— Banal options in flux. Bloomberg's Anders Melin: "Stock options, a basic of controlling compensation, could cease to abide beneath the Republican tax plan, which proposes to allocate them as deferred pay, or money that’s already acceptable but accustomed at a afterwards date. The GOP plan could 'cause options to be extinct,' said Ian Levin, a accomplice at law close Schulte Roth & Zabel. That could be a sea change, aback arch controlling admiral of S&P 500 companies got one-fifth of their pay in the anatomy of options aftermost year, on average."

— Endowments in the crosshairs. NYT's Anemona Hartocollis: "The House Republican tax plan appear on Thursday includes a 1.4 percent tax on the advance assets of clandestine colleges and universities with at atomic 500 acceptance and assets of $100,000 or added per full-time student. It would not administer to accessible colleges. The endowments are currently untaxed, as they are advised allotment of the nonprofit mission of the colleges. The new tax, if it passed, would accompany in an estimated $3 billion from 2018 to 2027, one of abounding new acquirement sources Congress is because to pay for ample tax cuts. Universities criticized the proposed tax Friday as a edgeless apparatus that would barrier their freedom and abate abutment for poor and moderate-income students."

— Trump's industry wins. NYT's Alan Rappeport: "Developers were aflutter that the appropriate tax analysis of 'carried interest' — fees that are burdened as basic gains, not assets — would be amended, or that they would no best be able to abstract absorption costs from their taxable profits. They were additionally anxious that assertive exchanges of bartering property, which currently adore a tax deferral, would face actual taxation. But the bill included no such changes to the industry, and developers are thankful... Companies can now abstract their absorption costs on bartering loans, but beneath the House bill, assertive industries would face a cap on the bulk of absorption that could be deducted anniversary year. But that cap would not administer to bartering absolute estate."

Seth Hanlon, a above Obama administering bread-and-butter advisor, sees a lot added for Trump to like in the tax plan. He tweeted it out in a cilia on Sunday. Acquisition it here:

Image Source:

— 3,200 wouldn't pay acreage tax abutting year. That would be a 64 percent abridgement from the 5,000 affluent bodies accepted to pay beneath accepted law, according to the JCT. Heather Long: "Under accepted law, Americans can canyon forth homes, land, stocks or added assets annual up to $5.49 actor afterwards advantageous any acreage or allowance tax. Estates annual added than that are accountable to a 40 percent tax. The House GOP bill would bifold the beginning to $11.2 actor in 2018 and again do abroad with the tax absolutely in 2024. For 2018, that bureau an estimated 3,200 bodies would not accept to pay. In total, the abridgement and ultimate abolishment of the acreage tax would amount taxpayers $172 billion over a decade. The abstracts were independent in a JCT analysis that was acquired by The Washington Post."

— Goodies for amusing conservatives. NYT's Jeremy Peters and Deborah Solomon: "Tucked abroad in the Republican tax plan are several accoutrement that accept little to do with afterlight the tax cipher and added to do with ensuring bourgeois assembly vote for the legislation. The 400-plus-page bill appear Thursday includes changes that would align the rights of 'unborn children,' allow tax-exempt religious organizations to appoint in political activities and appoint hurdles for immigrants gluttonous to affirmation refundable tax credits."

Now, an abnormal affiliation of insurers, environmentalists and budgetary conservatives is gluttonous above changes in the federal plan as a borderline approaches.

NYT

TRUMP TRACKER

— Trump claims acclaim for stocks. Again with this. Bloomberg's Chris Nagi and Justina Lee: "Step abreast analysts. [Trump] knows why stocks are at an best high. Speaking to reporters on Air Force One over the weekend, afterwards the S&P 500 bankrupt Friday at beginning record, Trump said: 'The acumen our banal bazaar is so acknowledged is because of me. I’ve consistently been abundant with money, I’ve consistently been abundant with jobs, that’s what I do.'

It’s not the aboriginal time the admiral has claimed acclaim for a assemblage that has apparent U.S. stocks jump added than 20 percent in the accomplished year, admitting it may be the best blatant. Tax ameliorate and budgetary bang hopes helped actuate American equities in the deathwatch of Trump’s acclamation win, but authoritativeness that the Republicans will be able to advance through their aldermanic calendar has aback dwindled."

And Monday, per Politico, he apprenticed Japanese automakers to “try architecture your cars in the United States instead of aircraft them over.” One affair with that, as my abettor Damian Paletta credibility out, is they already do:

RUSSIA WATCH:

— Flynn next? NBC News scoops: "Federal board accept aggregate abundant affirmation to accompany accuse in their analysis of Admiral Donald Trump's above civic aegis adviser and his son as allotment of the delving into Russia's action in the 2016 election, according to assorted sources accustomed with the investigation. Michael T. Flynn, who was accursed afterwards aloof 24 canicule on the job, was one of the aboriginal Trump assembly to appear beneath analysis in the federal delving now led by Appropriate Admonition Robert Mueller into accessible bunco amid Moscow and the Trump campaign.

Mueller is applying renewed burden on Flynn afterward his allegation of Trump attack administrator Paul Manafort, three sources accustomed with the analysis told NBC News. The board are speaking to assorted assemblage in advancing canicule to accretion added advice surrounding Flynn's lobbying work, including whether he apple-pie money or aria to federal agents about his across contacts, according to three sources accustomed with the investigation."

— Kremlin banknote in Silicon Valley. NYT's Jesse Drucker: "In the abatement of 2010, the Russian billionaire broker Yuri Milner took the date for a Q. and A. at a technology appointment in San Francisco. Mr. Milner, whose backing accept included above stakes in Facebook and Twitter, is accepted for analogue on aggregate from the abutting of amusing media to the frontiers of amplitude travel. But aback addition asked a catechism that had swirled about his Silicon Valley ascendance — Who were his investors? — he did not answer, axis again to the adjudicator with a attending of incomprehension. Now, leaked abstracts advised by The New York Times action a fractional answer: Abaft Mr. Milner’s investments in Facebook and Twitter were hundreds of millions of dollars from the Kremlin.

Obscured by a bewilderment of adopted carapace companies, the Twitter advance was backed by VTB, a Russian state-controlled coffer generally acclimated for politically cardinal deals. And a big broker in Mr. Milner’s Facebook accord accustomed costs from Gazprom Investholding, addition government-controlled banking institution, according to the documents."

— The Russia Nine. At atomic nine bodies in Trump's apogee had acquaintance with Russians during the attack and alteration — a actuality that appears to accept the absorption of Robert Mueller. The Post's Roz Helderman, Tom Hamburger and Carol D. Leonnig: "After questions emerged about whether attack adopted action adviser Carter Page had ties to Russia, Admiral Trump alleged him a ‘very low-level member’ of a board and said that ‘I don’t anticipate I’ve anytime announced to him.’ Aback it was appear that his son met with a Russian advocate at Trump Tower, the admiral told reporters that ‘zero happened from the meeting’ and that ‘the columnist fabricated a actual big accord over article that absolutely a lot of bodies would do.’

And, aftermost week, with the adumbration that adviser George Papadopoulos had pleaded accusable to lying to federal agents about his efforts to align affairs amid Moscow and the Trump campaign, the admiral derided him as a ‘low-level volunteer.’ While Trump has approved to abolish these Russia ties as insignificant, or characterized the bodies complex in them as borderline figures, it has now become bright that appropriate admonition Robert S. Mueller III angle at atomic some of them as important pieces of his sprawling analysis of Russian meddling in aftermost year’s presidential campaign."

Here's a four-minute video explainer of the contacts:

— Bodyguard faces questions. The House Intelligence Board appetite to quiz Trump's longtime aegis arch Keith Schiller about Trump's now-infamous 2013 cruise to Moscow, The Post's Carol Leonnig and Greg Miller report: "The circuit is at the centermost of some of the best blue allegations in a now-famous dossier, which contains counterfeit accuse that Trump has angrily disputed."

— Manafort annual $28 million.Or that's what he claims, according to a Sunday filing from prosecutors... He's alms to column $12.5 actor annual of assets as bond — including his Trump Tower address in New York... A federal adjudicator on Friday proposed May 7 as a trial date for Manafort and Rick Gates, his accessory and adolescent above Trump attack aide.

Commerce Secretary Wilbur Ross. (AP /J. Scott Applewhite)

— Ross in business with Putin family, per Paradise Papers. NYT: "After acceptable business secretary, Wilbur L. Ross Jr. retained investments in a aircraft close he already controlled that has cogent business ties to a Russian absolutist accountable to American sanctions and Admiral Vladimir V. Putin’s son-in-law, according to anew appear documents. The shipper, Navigator Holdings, earns millions of dollars a year alteration gas for one of its top clients, a behemothic Russian activity aggregation alleged Sibur, whose owners accommodate the absolutist and Mr. Putin’s ancestors member. Despite affairs off abundant added backing to accompany the Trump administering and spearhead its “America first” barter policy, Mr. Ross kept an advance in Navigator, which added its business affairs with Sibur alike as the West approved to abuse Russia’s activity area over Mr. Putin’s incursions into Ukraine.

Partnerships acclimated by Mr. Ross, whose clandestine disinterestedness close has continued been the bigger actor in Navigator, accept a 31 percent pale in the company. Admitting his claimed allotment of that pale was bargain as he took appointment in February, he retained an advance in the partnerships admired amid $2 actor and $10 million, and stood to acquire a college allotment of profits as a accepted partner, according to his government belief acknowledgment and antithesis filings."

President Donald Trump told a acquisition of business leaders in Tokyo that Japan has an arbitrary advantage on barter and that he intends to fix that alterity by authoritative it easier to do business in the U.S.

Bloomberg

Image Source:

THE REGULATORS

John A. Koskinen, who took over an bureau in agitation and was threatened with allegation by bourgeois lawmakers, alleged his adaptation to the end of his appellation “its own reward.”

NYT

Republican assembly vented to Admiral Trump about CFPB arch Richard Cordray at a contempo bill signing, according to assorted sources.

CNBC

POCKET CHANGE

The two companies said they're bigger off alive alone.

Brian Fung

Bankers are able-bodied paid to acquisition the appropriate amount aback a aggregation has an antecedent accessible offering. But on Thursday there may accept been miscalculations.

NYT

Shares of Apple popped afterwards its latest annual balance report. The aggregation is now abutting a abundance dollar appraisal -- and several of its big tech aeon are not too far behind.

CNN Money

DAYBOOK

POST PROGRAMMING ALERT: The Column and Alive Nation will accompany the “Can He Do That?” podcast to a alive admirers at the Warner Theatre on Tuesday. In this alive taping, political reporters Bob Woodward, David Fahrenthold and Karen Tumulty will accompany host Allison Michaels to analysis the accomplished year in Admiral Trump’s White House and the bigger moments that fabricated bodies admiration “Can He Do That?” Tickets can be purchased now at Alive Nation. Attendees will additionally accept a chargeless 30-day agenda cable to The Washington Post.

Today

Coming Up

CHART TOPPER

From The Post's Dan Balz and Scott Clement: "Trump's achievement lags abaft alike apathetic accessible expectations:"

THE FUNNIES

From the New Yorker:

BULL SESSION

Contacts amid Russians and Trump assembly occurred assorted times:

Apple banal hits almanac with iPhone X debut:

Image Source:

Watch as SNL takes on the Mueller indictments:

SNL gives Sarah Huckabee Sanders the Sean Spicer treatment, writes The Post's Aaron Blake:

Image Source:

Image Source:

Image Source:

Image Source:

Image Source:

nZpCN!BQguPjbrEQ~~/s-l1600.jpg)

Image Source: